haven't done my taxes

Whether you are filing as an individual or as a business you likely will see a few changes this year when you file your 2018 federal income tax return. Level 15 July 14 2022 214 PM.

Trying To Call The Irs Is Nearly Impossible Right Now Here S What To Do Forbes Advisor

Are you a w-2 employee.

. That extension will not change the due date for any money you need to pay the IRS. Regardless of your reason for not filing you should file your federal tax return as soon as possible. GameStop Moderna Pfizer Johnson Johnson AstraZeneca Walgreens Best Buy Novavax SpaceX Tesla.

But if you filed your tax return 60 days after the due date or the. It would be very difficult to have a tax owed if you are a w-2 employee. Answer 1 of 2.

The penalty charge will not exceed 25 of your total taxes owed. If you succeeded in attaining a tax filing extension Monday Oct. Lilbaby lifeisgood drake future Baby goes Live on IG vibe to Drake Future new song Life is Good and says I havent done my taxes Im too turnt up.

17 this year to get your paperwork together. The CRA will let you know if you owe any money in penalties. Take advantage of all the available tools found on.

15 to file a return the date falls on a Saturday in 2022 so taxes are due by the following Monday Oct. If youre overwhelmed with your taxes they might be able to support you with any tax issues as you file. If you are one of the many.

The failure-to-pay fee is equal to 05 of the tax owed after the due date for each month or part of a month that the tax remains unpaid. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. The criminal penalties include up to one year in prison for each year you failed to file and fines up to.

I havent done my taxes 0 3 125 Reply. If the IRS has not contacted you then you either moved and they dont know. Using the IRS Wheres My Refund tool.

Business Economics and Finance. This penalty is usually 5 of the unpaid taxes. 17 is the final day this year to file your 2021 taxes if you havent yet done so.

Contact a tax professional. Viewing your IRS account information. Subscribe to RSS Feed.

15 2022 at 1214 pm. This amount can total up to 25 of. In other words a tax extension will give you until Oct.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. If youre required to file a tax return and you dont file you will have committed a crime. While a tax extension typically gives you until Oct.

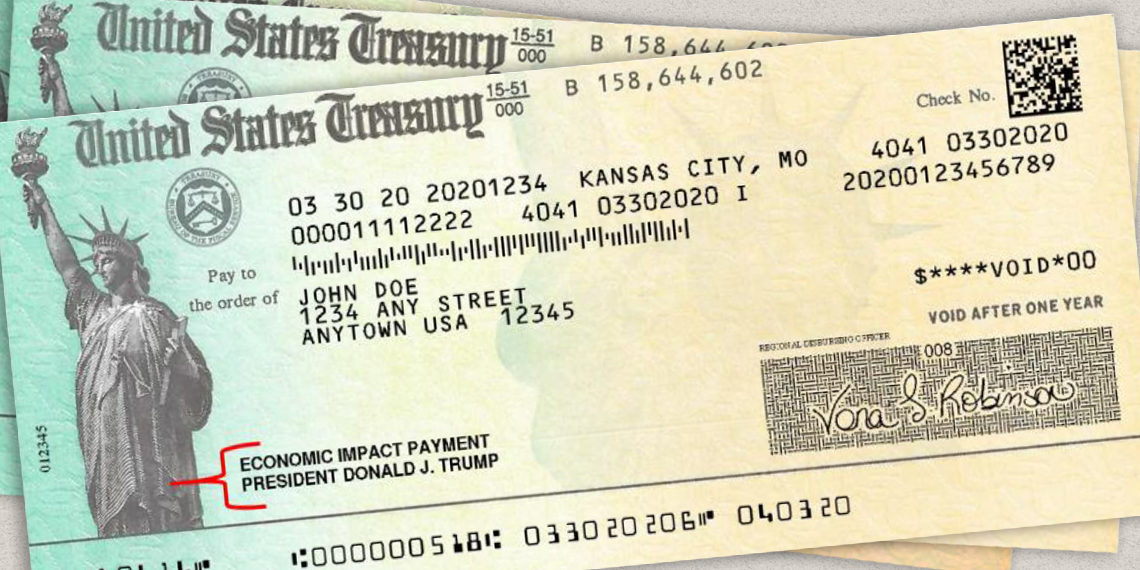

9 hours agoHowever youll need to make sure youve filled out the necessary forms in order to receive your payment -- and the deadline to do so is Monday Oct. 9 Bills You Should Never Put on. The IRS wants you to get your stimulus check and child tax credit cash if you havent claimed it heres what to look for Last Updated.

When you owe money and are late with a tax return you get penalized to the tune of 5 per month or partial month your return is late up to a total of 25. So lets say you owe the.

Xclusive Taxes Irs Says It Won T Extend Tax Filing Deadline Again Beyond July 15 Contact Us Today To Schedule An Appointment To File Your Taxes We Are Conducting Virtual Appointments Www Xclusivetaxes Com

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Stream Haven T Done My Taxes I M Too Turnt Up By Burbank Listen Online For Free On Soundcloud

Haven T Done My Taxes I M Too Turnt Up Single By Le Marcus Spotify

Who Goes To Prison For Tax Evasion H R Block

What Happens If I Don T File My Taxes Forbes Advisor

Amazon Com Haven T Done My Taxes Too Turnt Up 2020 Tax Accountant Premium T Shirt Clothing Shoes Jewelry

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

I Haven T Done My Taxes I M Too Turnt Up T Shirt For Sale By Ravishdesigns Redbubble I Havent Done My Taxes Im Too Turnt Up T Shirts Life Is Good T Shirts

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

4 Steps If You Haven T Filed Your Taxes In A While Inc Com

Where S My Refund Tax Refund Tracking Guide From Turbotax

Haven T Filed Taxes In Years What You Should Do Youtube

Still Waiting On Your Tax Refund Here S What To Do Sep Experian Experian

Delayed By Virus Tax Day Is Here The New York Times

What You Need To Know If You Haven T Received Your Second Stimulus Payment

If You Filed For A Tax Extension You Have Until October 17 To File Here S Why You Shouldn T Wait Nextadvisor With Time

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service